OUR

HEDGE FUNDS

ON-CHAIN TranspareNCY

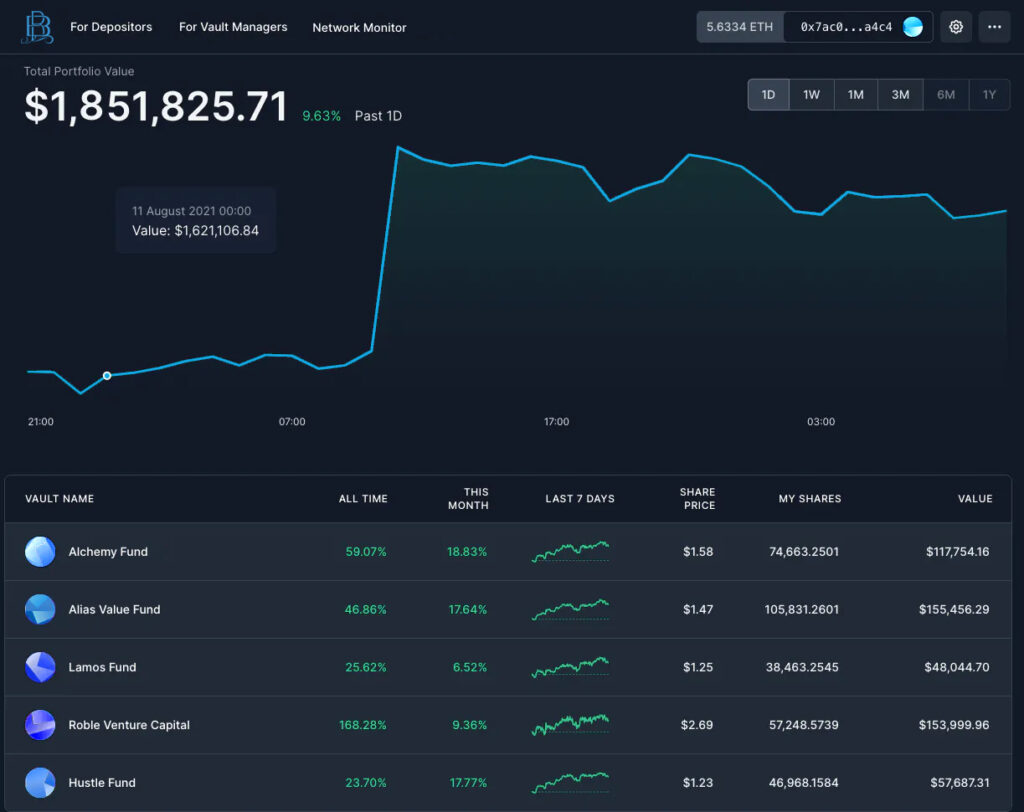

The Vault is a de-centralised Blockchain token known as a TGE (Token Generation Event), which is providing our clients with intrinsic protection utilising hybrid Smart Contracts on the Ethereum blockchain and a Self Regulated Technology Asset Management Protocol.

The Vault is a new technology enabling us to make a representation of our collective Investments into one Vault/Token and is delivered digitally to our clients and tracked on the Ethereum Smart Contract network.The Hedge Fund offers clients a secure and clear audit trail and proven track record.

The Vault is a new technology enabling us to make a representation of our collective Investments into one Vault/Token and is delivered digitally to our clients and tracked on the Ethereum Smart Contract network.The Hedge Fund offers clients a secure and clear audit trail and proven track record.

Track Record

Fee Schedule

Compliance Policies

And much more

Our Hedge Fund Vaults are a new breed of digital Hedge Funds composed of a mixture of Funds to match Investment Objectives or requirements using Venture Capital and capital investments using a Global Macro Strategy and market arbitrage we carefully select the Industries, Technologies, Companies and Protocols in the Blockchain space that we feel have a great investment potential, our funds are best suited for investors with a medium to high degree of risk tolerance.The key risks of our Funds is the full exposure to the global crypto Currency Markets however we feel this exposure and risk is to be greatly rewarded and is mitigated by our Monitoring of current eco-global and political situations.

Our portfolio are made up of a large weighting of large market capitalisation, high yield crypto currencies and trading strategies using companies and strategies that have been approved by our Advisory Board and Research Team.

The Basics

We do not invest into anything that we are not comfortable to be invested into for the long term – although we are dealing with fully liquid and ready realisable markets and assets only.

We invest into technologies, digital currencies and protocols that we feel are going to shape or change our industries over the next 5 to 10 years.

We invest with uncorrelated risk from todays mainstream Fiat, Stock and Financial Markets the blockchain is providing spectacular alternative growth.

We give full and professional Investment Management and makes changes to the Portfolio on an active basis, using market Arbitrage and a Global Macro Investment Strategy we hedge different Fiat and Crypto entry and exit points that gives us optimal returns on our investments.

We hedge and safeguard Portfolios no matter what happens in the market, with our long-term trend following strategies based on our perspectives of Economic Fundamentals prevents short-term thinking from impairing long-term performance.

Using our extensive financial trading experience the rebalancing of our Portfolio allows us to underweight and overweight the tokens or positions the market is valuing more than others at the time which gives the security over the volatility in these markets.

Whilst Crypto Currencies are extremely volatile our rigorous and disciplined process demonstrates that with the correct asset selections and correct asset diversification the rewards more than outweigh the risk.

How can investors check and verify trades?

You deserve to know how your money is being managed that is why we have announced a partnership with TAAS to use their Blockchain Regulation and Self Audi platform that will give investors complete transparency over the funds’ investments.

Even though the Fund Vaults are self regulating in itself, we have also contracted KPMG to provide an audit of funds and are currently in talks with them to provide further ongoing auditing services for our clients and partners.

If you have sent funds and the Vault tokens are not showing up yet, it may be due to synching issues, you can however verify on our Smart Contract page on Etherscan that you have Vault tokens in your wallet.

Book an appointment with one of our specialists

OUR PartnerS